Top of Page

- Links to move inside this page.

- HOME

- Investor Relations

- Integrated Report Portal

- Financial Strategy

Financial Strategy

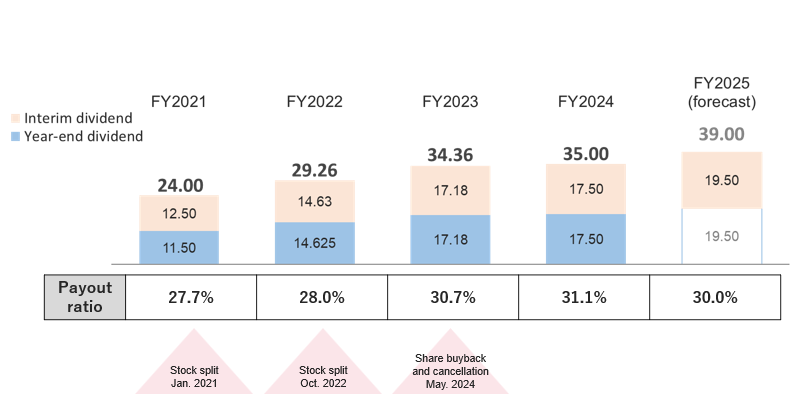

Basic Policy on Shareholder Returns

The IT market for enterprises is expected to grow more in demand as the need for DX (Digital Transformation) is advocated. Under such a growing market, IIJ Group is in the midst of growth, and aims to achieve continuous enhancement of its corporate value by expanding the scale of business while increasing revenue growth and operating profit margins. In recent years, IIJ has maintained an adjusted dividend payout ratio of approximately 30% as returns to shareholders, and dividend per share has been largely increasing in line with profit growth. IIJ plans to increase returns to shareholders along with profit growth while taking into consideration a certain level of retained earnings and strengthening its financial position in order to flexibly respond to business investments ahead of competitors and M&A opportunities that would accelerate its growth.

During the FY2024-FY2026 mid-term plan, we set the dividend payout ratio target as 30% based on our capital allocation plan which considers an increase in capital investment for further business growth and working capital along with an increase in the acquisition of large-scale projects. As for the details, please refer to "IIJ Group Mid-term Plan (FY2024-FY2026) and Mid-to-Long Term Vision![]() ," which was disclosed on May 10, 2024.

," which was disclosed on May 10, 2024.

Dividend Per Share

(As of March 2024)

Approach to Investment

Business Investment

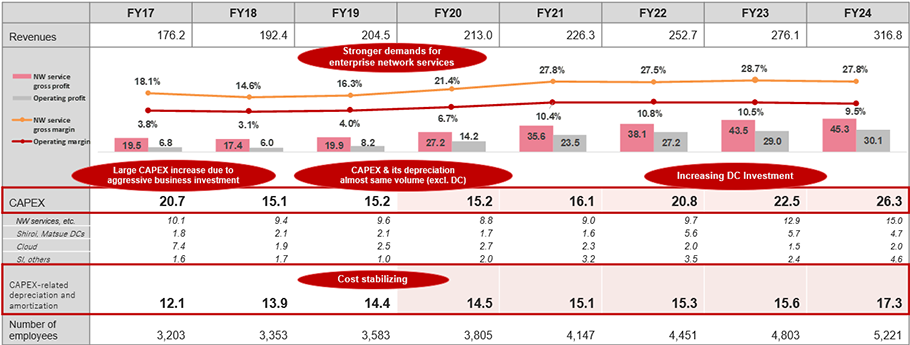

IIJ Group believes that expansion of business scale is important to continuously demonstrate its competitiveness in a growing market, and therefore pays close attention to revenue growth rate as a management indicator. Profitability tends to improve along with revenue growth, and IIJ Group also considers operating income and operating margin to be important indicators, which are linked to ROE. In addition, IIJ Group calculates WACC as an indicator of cost of capital, which is informed well within the company and used for the decision of business investment. Business investment and service development in new technological and other areas are continuously required, and these have been actively promoted. Business investments are evaluated through measures such as IRR with flexible assumptions depending on the nature of business, and decisions are made at the Board of Directors meetings and/or management meeting in consideration of resource allocation to existing core, growth, and new business areas as a portfolio. Their returns on investments are monitored by each business and service.

Capital Investment

IIJ Group's major capital investments consist of acquiring facilities for service operations, such as networks, Cloud and data centers, and customer facilities required for systems integration, and software development. In anticipation of market expansion, after IIJ Group had increased its capital ordinary investment level prior to FY2017, IIJ Group has continued to invest at that level, excluding construction of data centers, since then. Although IIJ Group has been continuously expanding network infrastructure and actively developing services, in recent years its investment and depreciation costs have remained stable in balance. IIJ Group expects such a situation to continue for the foreseeable future.

M&As

Although organic growth has been a core driver of IIJ Group's business, in the past, IIJ Group has executed M&As and PMI (post-merger integration process) such as IIJ Global Solutions Inc. (acquired the domestic network business from AT&T in 2010), which provides WAN services, IIJ Protech Inc. (M&A in 2014), which acquires and supplies engineers, PTC SYSTEM (S) PTE LTD (M&A in 2021), which is a leading local system integrator in Singapore, and PTC SYSTEMS SDN.BHD(M&A in 2023), which is a local system integrator in Malaysia. These companies have been demonstrating the effects of collaboration within IIJ Group. IIJ Group considers that securing resources is important to realize further growth in the future.

Therefore, IIJ Group shall continue to pursue M&A opportunities.

Strategic shareholdings

Considering the Company's business strategies, relationships with its business partners, and cost of capital thoroughly, the Company might hold shares of listed companies as strategic shareholdings in some cases if the Company believes such shareholdings enhance its corporate value and bring profit to its shareholder. Regarding strategic shareholdings, the Company sold all shares of two stocks in FY2017 and a part of one stock in FY2019. The Company held four stocks, the fair value of which was ¥7.83 billion on the balance sheet, as of March 31, 2023. The Company confirms whether the margins generated from ongoing transactions and dividends received, with each investee as strategic shareholding, exceed its cost of capital on an annual basis, and evaluates and decides the propriety of the strategic shareholdings based on historical records and future prospects in business transactions and business contribution in terms of its cost of capital. Regarding the exercise of voting rights for strategic shareholdings, the Company comprehensively reviews management policies and business situations as well as the contents of proposed subjects to be resolved at general meetings of those companies. The Company exercises voting rights from the viewpoint that its voting leads to an improvement of those companies’ corporate value in the medium- to long-term.

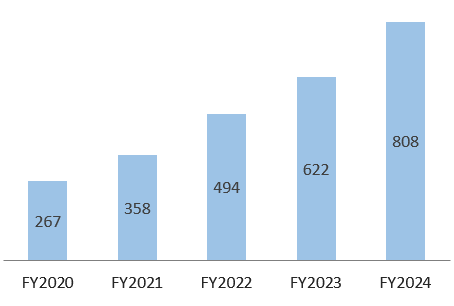

Communication with Capital Markets

IIJ Group is in the middle of growth and recognizes that close communication with the capital markets is very important. Management members directly communicate with shareholders, institutional investors, and analysts through road shows, conferences, and individual meetings in Japan and overseas.

In order to disclose information on IIJ Group in an appropriate, timely, and fair manner, IIJ discloses important information such as annual securities reports, quarterly reports, financial results, presentation materials, convocation notice of general meeting of shareholders, and consolidated reports in Japanese and its English translation on the same day. Furthermore, IIJ Group recognizes the importance of addressing ESG issues through its business activities in order to achieve long-term sustainable growth of IIJ Group and society. IIJ Group has disclosed information based on the TCFD framework, expanded disclosure of its diversity policy and targets, and also been continuously communicating with ESG rating agencies.

The number of IR meetings

End of the page.