Top of Page

- Links to move inside this page.

- HOME

- Investor Relations

- ESG Initiatives

- Corporate Governance

- Overview of Corporate Governance

Overview of Corporate Governance

Overview of corporate governance

IIJ Group's business philosophy (raison d'etre or purpose) is as follows.

- To develop network infrastructure through technological innovation

We are committed to the ongoing pursuit of initiatives in the field of Internet technology to open up the future of the digital society through new value created by ever faster networks and computing. - To provide solutions (IT services) that supports a networked society

We continuously develop and introduce highly reliable and value-added IT services that anticipate changes taking place around the world, to support the use of networks by society and individuals. - To provide meaningful opportunities for growth to our employees (a place where human resources with diversified talents and values can play an active role)

We aim to offer meaningful working opportunities for growth through business, in which our staff can take a proactive approach to technical innovation and social contribution, and actively demonstrate their abilities with pride and a sense of satisfaction. We aspire to be a company where employees are never satisfied with the status quo, and are always thinking about the future world, contributing to social development, and achieving personal growth through work that has value for society.

IIJ Group recognizes the importance of implementing and enhancing corporate governance in order to consistently realize the business philosophy, fulfill its mission to support and manage Japan's Internet which has become an essential part of society's infrastructure, and continue to increase its corporate value.

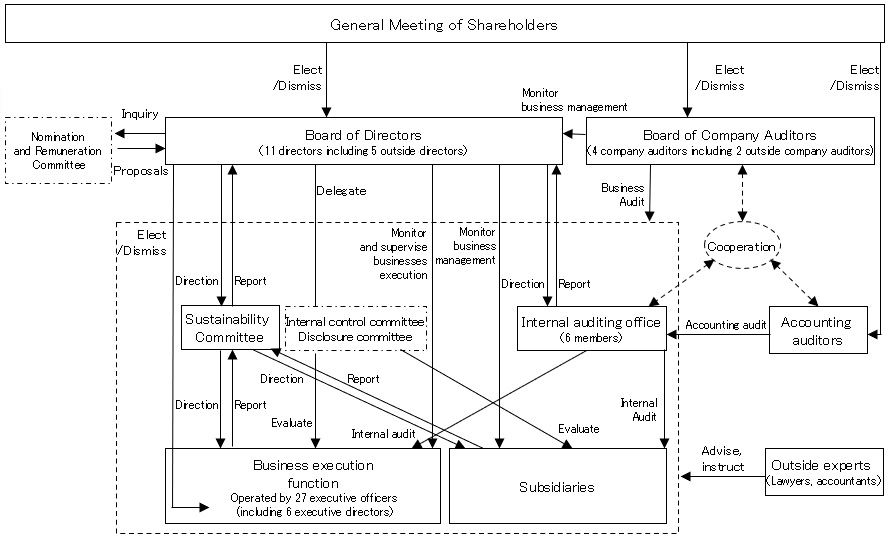

The overview of IIJ Group's corporate governance system is as follow.

Overview of the Corporate Governance System

General Meeting of Shareholders

IIJ is a joint stock corporation under the Companies Act of Japan, and the General Meeting of Shareholders is the highest level of decision-making body.

Based on the Companies Act of Japan and the "Articles of Incorporation," the main subjects to be resolved at the General Meeting of Shareholders are as follows.

| Subjects | Requirements for resolution |

|---|---|

| Appointment or dismissal of Directors/Appointment of Company Auditors | Ordinary resolution(*1) |

| Determination of the total aggregate amount of remuneration for directors | Ordinary resolution(*2) |

| Dividends of Retained Earnings | Ordinary resolution(*2) |

| Amendment to the "Articles of Incorporation" | Special resolution(*3) |

| Dismissal of company auditors | Special resolution(*3) |

| Company mergers or splits | Special resolution(*3) |

- (*1)In accordance with the "Articles of Incorporation," a resolution by a majority of the votes of the shareholders who attend the General Meeting of Shareholders at which one-third or more of the shareholders including proxies with voting rights are present.

- (*2)A resolution by a majority of the votes of the shareholders who attend the General Meeting of Shareholders at which a majority of shareholders including proxies with voting rights are present.

- (*3)In accordance with the "Articles of Incorporation," a resolution by two-thirds or more of the votes of shareholders who attend the General Meeting of Shareholders at which one-third or more of shareholders including proxies with voting rights are present.

Related laws and regulations

As a telecommunications operator, IIJ operates its business in compliance with the Telecommunications Business Act which is under the jurisdiction of the Ministry of Internal Affairs and Communications in Japan. IIJ is required to secure the secrecy of telecommunication contents, provide appropriate explanations of the conditions of service provision, and manage telecommunications facilities for its business operation in order to ensure the reliable and stable provision of telecommunications services. In addition, IIJ Group operates its business in accordance with relevant domestic and foreign laws and regulations, including the following ones listed below.

- Act on the Protection of Personal Information, the General Data Protection Regulation (GDPR) in the European Union, and other laws and regulations regarding appropriate information management

- Unfair Competition Prevention Act, Act against Delay in Payment of Subcontract Proceeds to Subcontractors, and other laws and regulations related to ensuring fairness in transactions

- Consumer protection related laws and regulations including Consumer Contract Act, Act against Unjustifiable Premiums and Misleading Representations, Act on Specified Commercial Transactions

- Copyright Act, and other laws and regulations regarding intellectual property protection

- Act on the Rational Use of Energy, Waste Disposal and Public Cleansing Act, and other laws and regulations regarding environment

- Labor Standards Act, Industrial Safety and Health Act, and other laws and regulations regarding working environment

The basic framework of internal control

American Depositary Shares ("ADSs") of IIJ were listed on the NASDAQ Exchange ("NASDAQ") in 1999 and IIJ had been implementing and operating its internal control system based on the COSO's framework (*4) since the enforcement of the Sarbanes-Oxley Act (SOX Act) in the U.S. IIJ delisted its ADSs from the NASDAQ in 2019 and has been operating its internal control system based on the Basic Framework of Internal Control incorporated in the Financial Instruments and Exchange Act of Japan (so-called "J-SOX") since then. IIJ aims to provide the rational assurance of the effectiveness and efficiency of operations, the reliability of financial reporting, the compliance with laws and regulations related to business activities, and the preservation of assets through the establishment and operation of internal control system. The basic concept of internal control is stipulated in the "Basic Rules for Internal Control."

- (*4)The Committee of Sponsoring Organizations of the Treadway Commission

- Requesting for compliance with laws and regulations, fair trade, elimination of conflicts of interest, and proper transactions with government agencies etc.

- Ensuring the confidentiality of information and the preservation of company assets

- Assuring accurate records of financial figures and financial reports

- Paying due consideration for stakeholders

- Taking exclusionary measures against antisocial forces

- (*5)In order to thoroughly prevent bribery, IIJ Group has established the "Anti-bribery Rule" and required all IIJ Group's officers and employees to comply with it. IIJ Group has also required its business partners to comply with laws and regulations, including the prohibition of bribery, as a part of terms and conditions of business.

- Note:Mr. Takashi Tsukamoto, formerly served as an executive of Mizuho Bank, Ltd., which is one of banks IIJ borrows from, and its parent company of Mizuho Financial Group, Inc. It has been more than ten years since he had left those roles in 2014 and he is currently a Special Advisor of Mizuho Financial Group and not engaged in any business execution. Therefore, in accordance with the Tokyo Stock Exchange's rules and regulations, he has been designated as an independent outside director.

- Auditing and verifying the status regarding the implementation and operation of IIJ Group's internal control system based on laws and regulations such as the Companies Act and Financial Instruments and Exchange Act including "J-SOX"

- Maintaining the soundness of financial reporting for the entire group, including subsidiaries and equity method investees, in cooperation with the accounting auditor

- Identifying governance issues through attendances at important meetings and interviews with officers and employees, and providing advice and recommendations to the Board of Directors and officers

- Applying the "Code of Ethics" and other overall group rules to all subsidiaries

- Promoting business collaboration and enhancing business management by assigning IIJ's business managers to subsidiaries as part time directors and/or company auditors

- Executing consolidated audits by assigning IIJ's company auditors to important subsidiaries as part time company auditors

- Managing subsidiaries' monthly performance by CFO and IIJ's Finance and Accounting departments

- Governing subsidiaries' on-going administrative operation mainly by IIJ's Compliance, and Corporate Communications departments, etc.

- Transferring and accepting employees within IIJ Group and operating group CMS(Cash Management System)

- Monitoring related party transactions at the meeting of the Board of Directors based on the Arm's length rule

The components of internal control include the control environment, the risk assessment and the implementation of control against risks, the control activities, information and communication, monitoring activities, and information technology (IT). The control environment determines the ethos of the organization, influencing the awareness of all officers and employees toward control, and forms the basis for the other components. Therefore, IIJ Group recognizes the importance of the control environment as the foundation of the control. IIJ has established the "Code of Ethics" as the basis of the control environment, which has applied to the entire IIJ Group, and required all officers and employees to comply strictly with it. Top management conveys IIJ Group's business philosophy and the content of the "Code of Ethics" to all officers and employees on a regular basis to implement them. In addition, IIJ informs the details of the "Code of Ethics" to IIJ Group's officers and employees once a year and requests for the strict compliance. The main elements of the "Code of Ethics" are as follows.

IIJ has established internal rules for the Board of Directors, the Board of Company Auditors, organization, the segregation of duties, administrative authorities, accounting, information disclosure, the management of subsidiaries, the prevention of insider trading, internal audit, whistleblower protection, anti-bribery (*5), document management and so on, based on the "Basic Rules for Internal Control" and the "Code of Ethics," which require all officers and employees to comply with them. These rules have an enforcement mechanism, and if by any chance serious violations occur disciplinary penalties are applied.

Initiatives for Bribery Prevention

IIJ Group has the code of conduct that prohibits bribery in the course of our domestic or overseas business activities whether directly or indirectly such as providing money, other valuable things or services to persons who belong to an organization corresponding in substance to a government agency of Japan or a foreign country for the purpose of obtaining wrongful gains and other activities prohibited as bribery under the laws of each countries. Any officers or employees who violate the code of conduct shall be subject to disciplinary action in accordance with the employment regulations.

Internal controls have been established for the entire IIJ Group in order to prevent bribery. IIJ Group also notifies its officers and employees of the code of conduct and provides them with educational training on anti-bribery. In addition, a hotline for consultation has been established at its head office. Any violation of the code of conduct shall be subject to the whistleblowers hotline system for the entire IIJ Group.

As for the fiscal year ended March 31, 2025, there was no disciplinary action taken for the violation of the code of conduct regarding bribery.

Operation of whistleblowers hotline system

IIJ Group operates a whistleblowers hotline system, with contact points in accordance with legal requirements, to ensure compliance with laws and regulations regarding corporate activities and to enhance and maintain corporate ethics. IIJ ensures the effectiveness of the whistleblowers hotline system by securing the anonymity of whistleblowers and prohibiting disadvantageous treatments.

When it comes to internal control over financial reporting, each business process is visualized in the "Internal Control Description." The fulfillment of the internal control description is checked by each department and assessed by the Internal Auditing Office. IIJ's accounting auditor, KPMG AZSA LLC, conducts an internal control audit as well. The accounting auditor stated that the internal control report was appropriate as follows.

Summary of audit of internal control as of March 31,2025

No material weakness to be disclosed in the internal control system over financial reporting.

Board of Directors

IIJ's Board of Directors consists of 11 directors, including five independent outside directors. The profiles of the independent outside directors are as follows.

(As of the end of June 2025)

| Name | Year of appointment | Profiles |

|---|---|---|

| Takashi Tsukamoto |

2017 | Mr. Takashi Tsukamoto served as the President of Mizuho Bank, Ltd., etc. He is expected to oversee managerial executions mainly from the perspective of corporate management and his knowledge of finance. |

| Kazuo Tsukuda |

2020 | Mr. Kazuo Tsukuda served as the President and Representative Director of Mitsubishi Heavy Industries, Ltd., etc. He is expected to oversee managerial executions mainly from the perspective of corporate management. |

| Yoichiro Iwama |

2021 | Mr. Yoichiro Iwama served as the President and Representative Director of Tokio Marine Asset Management Co., Ltd., and Chairman of The Japan Securities Dealers Association, etc. He is expected to oversee managerial executions mainly from the perspective of corporate management and corporate governance. |

| Atsushi Okamoto |

2022 | Mr. Atsushi Okamoto served as the President and Representative Director of Iwanami Shoten, Publishers, etc. He is expected to oversee managerial executions mainly from the perspective of corporate management. |

| Kaori Tonosu |

2022 | Ms. Kaori Tonosu served as a board member of Deloitte Touche Tohmatsu LLC., etc. She is expected to oversee managerial executions mainly from the perspective of IT business, governance. |

Board of Company Auditors

IIJ has adopted and operated a system that is a company with the Board of Company Auditors defined in the Companies Act of Japan. When IIJ was listed on the NASDAQ in the U.S., it was exempted from clauses concerning the Audit Committee because of adopting the company with the Board of Company Auditors. The Company Auditors, who comprise the Board of Company Auditors and are delegated by shareholders, audit the execution of duties by directors from an independent position with an independent authority. The Board of Company Auditors has established audit policies and objectives as follows.

Main policies and objectives

IIJ has four company auditors, two of whom are independent company auditors. The profiles of the independent company auditors are as follows.

(As of the end of June 2025)

| Name | Year of appointment | Profiles |

|---|---|---|

| Takashi Michishita | 2016 | Mr. Michishita has ability to conduct audits from a professional perspective based on extensive corporate legal knowledge and experience as a lawyer. |

| Kumiko Aso | 2024 | Ms. Aso has ability to conduct audits from a professional perspective based on extensive finance and accounting knowledge and experience as a certified public accountant. |

Risk management system

Each executive officer is responsible for identifying and evaluating risks, and taking countermeasures against them in their business operations. Moreover, IIJ has established committees such as the "Internal Control Committee", the "Disclosure Committee" and the "Information Security Committee" to evaluate risks and take countermeasures against them depending on the type of risks. In case of emergencies, IIJ has set up and implemented the "Business Continuity Plan."

Sustainability promotion system

Regarding sustainability promotion, IIJ has established the Sustainability Committee, as a company-wide organization chaired by the President, to plan activity policies, consider and promote measures for each theme across the whole company, confirm and verify the progress, and submit and report the details of such activities to IIJ's Board of Directors.

IIJ's initiatives for sustainability are disclosed on "Sustainability". In addition, IIJ's climate-related disclosures based on the TCFD recommendations and human capital are disclosed on "Information Disclosure based on the TCFD Recommendations" and "Human Capital," respectively.

Group management

IIJ has been collaborating with its consolidated subsidiaries and some equity method investees, to closely work as IIJ Group. Business collaboration with major consolidated subsidiaries is described below.

| IIJ Global Solutions Inc. | Mainly provides WAN services among IIJ Group service offerings |

| IIJ Engineering Inc. | Provides operation center management services and customer support services for IIJ and its clients |

| IIJ Protech Inc. | Deploys IT personnel to IIJ and its clients |

| Overseas subsidiaries | Provide network services and systems integration to IIJ's Japanese clients on-site and operate global Internet backbone in some overseas subsidiaries |

For the group governance, IIJ has established "Management rules for subsidiaries" etc. and related practices as below.

End of the page.